BEST 2023 FOREX SUPER SIGNAL

BEST 2023 SUPER SIGNAL!!

TF: FROM H1 ONWARDS

Recommended Pairs: All + Crypto + Gold/Silver

BEST 2023 FOREX SUPER SIGNAL

You will be able to download the product once the payment is completed (instant)

PLATFORM: MT4

TF: FROM H1 ONWARDS

PAIRS: ALL + CRYPTO + GOLD/SILVER

We are excited to introduce to you our high-accuracy trading signal for the H1 TF.

This signal has been designed with the aim of delivering reliable and profitable results for traders of all levels. With its advanced algorithms and sophisticated approach, it is capable of detecting and taking advantage of market trends with a high degree of accuracy.

Not only does this signal provide a high degree of accuracy, but it is also flexible enough to be used in three distinct ways – Scalping (N°1), Pullbacks (N°2), and Trend Reversal (N° 3).

We’ve used custom indicators to streamline your trading experience. With the template loaded on a single EURUSD chart, you can effortlessly access any other currency pair or switch time frames with a single click.

To make it easier for you to recognize the expected type of trade, we’ve coded the signal with visual cues. Here’s what each one means:

1 = Scalping

2 = Pullbacks

3 = Significant moves or trend reversals are anticipated.

The signal is based on a combination of technical analysis and market sentiment, providing a unique perspective on the markets.

We’ve also included a Spread indicator to help you quickly detect high spread moments or pairs, allowing you to steer clear of trades that could start far from your target. As a precaution, we suggest avoiding spread levels above 10-12 points.

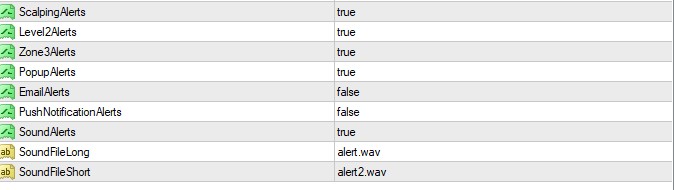

We have included all kinds of Alerts so you never miss a transaction:

-

Sound

-

PopUps

-

E-Mail

-

Push.

You can configure which alert to receive (Number 1 Scalping, 2 Pullbacks or 3 Reversal) according to your choice of trading, or you can receive them all!

Let’s start by recognizing the Scalping entry:

Number 1: Scalping Mode

In this mode, we won’t use the 3Zones indicator, we’ll simply wait for signal number 1 to appear. It’s important to emphasize that these signals are short-term, designed for fast trades, but on a large time frame. This is because a larger time frame provides greater accuracy compared to smaller time frames.

Good signals are quick and provide a zone where a significant buying or selling force is detected, it’s not an exact point. This means that the price will inevitably bounce within that zone.

There will always be two N° 1 signals. The first one opens the trade and the second closes it.

TP and SL:

The average TP (take profit) ranges from 150 to 400 PIPs, depending on the market and time zone, with the best results in New York or London Sessions.

New York or London Sessions:

Other sessions of different markets:

Start by setting a TP of 150 and adjust it as the trade progresses in your favor. Note that the signals are emitted for a zone, not a specific point, so it’s reasonable to have a SL (stop loss) of 100-150 for fast trades.

Keep in mind that the long time frame and large expected TP result in a favorable risk-reward ratio, so never set a SL below 100.

Number 2: Pullbacks Detection

Trades executed with signal number 2 detect a temporary pullback in the price enabling larger trades with greater profits compared to signal number 1.

It’s important to understand that this doesn’t indicate a change in the actual trend, but rather a temporary halt in the price’s movement before it returns to its original trajectory.

We will proceed to buy or sell in the same way as with Number 1:

Recommendation: open the trade at the appearance of the first “Number 2 signal” and close it upon encountering the second “Number 2 signal”, without using the 3 Zones indicator.

SL and TP:

We aim to benefit from these trades with an average TP of 500 pips. While trades are quicker in the New York and London sessions, they are slower in other markets. However, all trades ultimately reach their desired profit, just at a slower pace. To strike a favorable balance between risk and reward, we’ll utilize a stop loss of 200 pips for all “Number 2” trades.

-

If desired, you have the option to close your trade at a 1:1 ratio, meaning you would close your trade once you have gained 200 pips, which is equal to your stop loss. Some traders opt to open two trades simultaneously, both with a 200 pip stop loss, and then close one at a 1:1 ratio. The second trade is left open with the aim of achieving a better risk-reward ratio, such as 1:2 (stop loss at 200 pips and take profit at 400 pips or higher). This ultimately depends on the trader’s comfort level

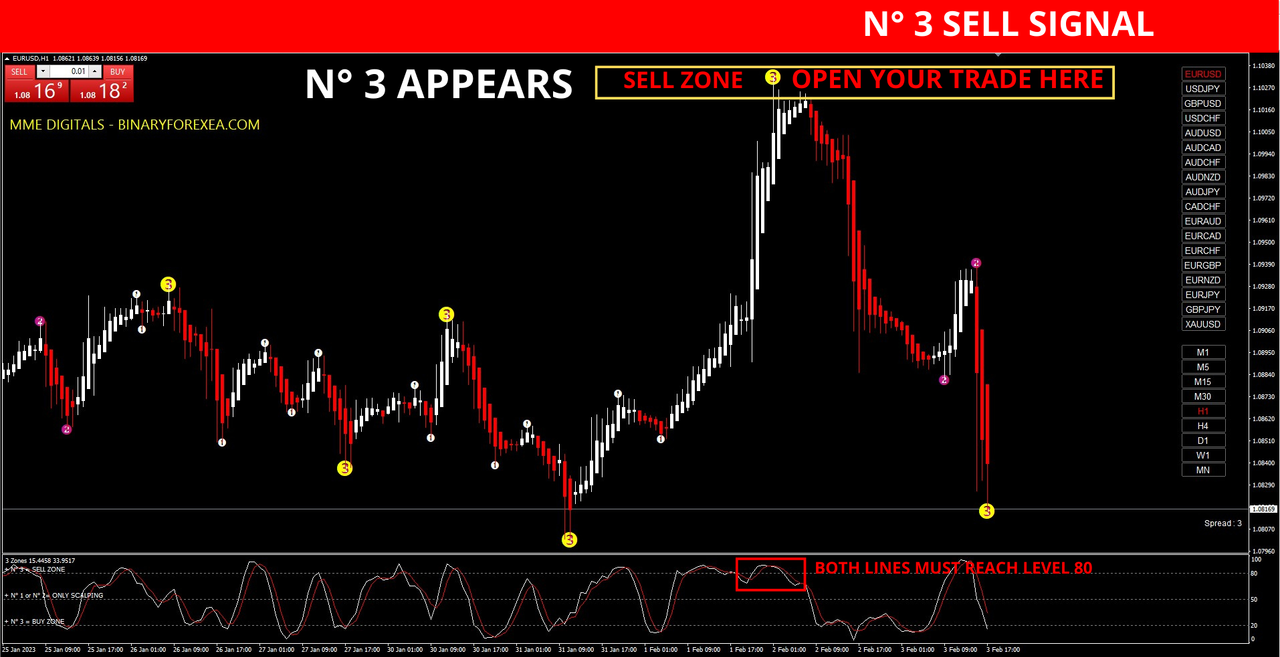

Number 3: Trend Reversal detection

A trend reversal refers to a change in the direction of a market trend. This is a general direction in which a market price or an asset is moving. A trend reversal occurs when the current trend changes direction and moves in the opposite direction. For example, if the market is in an upward trend, a trend reversal would occur when the market starts moving downwards. Various factors such as changes in market sentiment, economic indicators, geopolitical events, and technical signals can caused Trend Reversals.

Trend reversals are influenced by multiple factors that make it difficult to determine them.

Our signal, however, incorporates various indicators to minimize false trend changes, also known as pullbacks. This enables us to accurately determine the zone where the trend reversal will take place, rather than just a pullback.

Once detected, a trend reversal will inevitably occur in that zone, but it is important to note that it is not an exact point as it is impossible to determine.

Our strategy involves setting wide stop losses, which is made possible by the fact that our TP exceeds our SL by at least two times.

By having a wider stop loss, we can enter the market just before a trend reversal takes place, maximizing our chances of success and improving our final risk-reward outcome.

This setup also gives space for some price fluctuation without the frequent danger of being removed by the broker reaching our stop loss.

To buy and sell, we will do the same as with signals N°1 and N°2, but this time we will include the 3 Zones indicator:

-

BUY: we will need the number 3 to appear, and immediately check that the lower indicator is close to 20.

-

SELL: we will need the number 3 to appear, and immediately check that the lower indicator is close to 80.

AND, T H A T ‘ S I T !

We will expand a little on these 4 trades of the above chart to understand the expected SL and TP pips:

If we average these last 4 trades we will see that the average TP on this pair was 1647 pips, some trades with higher TP and some with lower TP. But in none of the cases it would be unreasonable to think in a SL of at least half of our TP, right? (SL1 : TP2).

Ok, so, a minimum SL of 350 would be perfect. Let’s risk only half of our potential minimum profit.

For H1 TF, a SL of 350 is pretty good, but for the type of trade (reversal) we are trying to achieve, it is minimal.

If we decide to go for the reversal (N° 3), our minimum SL should be 350.

The best technique to achieve the greatest profits:

-

Open two trades with the same stop loss (SL) value of 350 pips.

-

Close the first trade when it reaches a take profit (TP) value of 350 pips.

-

Leave the second trade open to capture the entire move, and close it when opposite signal #3 appears.

In case you’re unable to monitor the trade, simply set a TP value of 700 pips or more on the second trade.

This way, if the trade is successful, it will generate 350 pips from the first trade and at least 700 pips from the second trade, totaling 1050 pips, without having to constantly monitor the trade.

If you can monitor the trade, it’s important to note that the average return is 1647 pips. By being present, you can take advantage of the 350 pips from the first trade, as well as 1647 pips from the second trade, totaling 1997 pips in one single signal!

In summary, this strategy has an outstanding performance. The signal is early in defining a zone and it also allows a wide price movement. Additionally, setting a TP that is at least double the SL (with a typical 1:3 SL to TP ratio in most trades) gives us peace of mind when making our trades.

IMPORTANT:

For those who prefer late entries we’ve added an additional confirmation for a more secure trade:

(where the entry point isn’t as important as moving directly towards their desired direction, even if it means losing 150 pips)

This confirmation involves waiting for the Heiken Ashi candle to change color. To use this method, follow these steps:

1. The #3 signal appears.

2. The bottom indicator is at 20 (for buying) or 80 (for selling).

3. Wait for the first candle of a different color (for example, if the candles were white, wait for the first red candle to appear).

The candle that changes color may be lengthy, making the entry point much farther away from the desired location

Trading requires patience to enter at a favorable location, allowing enough space for the price to move. However, this strategy is versatile enough to accommodate for those who prefer this type of entry.

Here are some of our trades from February 1st.

Lastly, consider the following:

-

Spread should be low: The spread (the difference between the bid and ask price) should not be too high as it will impact the opening price of the trade. We have added a spread indicator to help monitor this. We recommend a spread of 10 pips or lower for better results.

-

Optimal trading time: It is best to trade during high-volatility periods such as the overlap of the New York and London markets. However, trading during other times is still possible, but the trades may be slower.

-

Check for news events: Before making a trade, it is crucial to check for any major news events, especially if they are marked as “red” for the currency pair you are trading. Avoid making trades if there is a red news event for a related currency pair.

-

Proper trade size: Avoid trading with large lot sizes if you have limited capital. This will make it difficult to set a proper stop-loss (SL) and may result in a loss if the SL is set too close to the trade price. Traders who are new to trading often make this mistake.

PACKAGE INCLUDE:

Indicators, Template, and Manuals will be sent in a compressed folder

FREE

USEFUL LINKS

WEEKLY NEWSLETTER

We Accept

© binaryforexea.com - Todos los derechos reservados