AUTO SUPPORT & RESISTANCE INDICATOR MT4

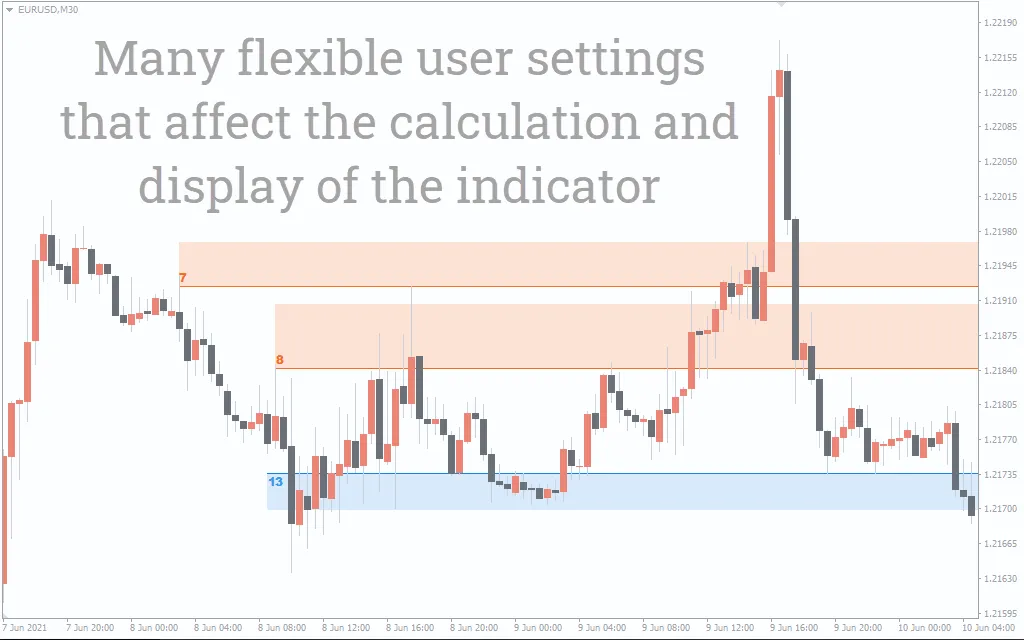

- Automatic construction of the most actual support and resistance zones in the forex market with the Support and Resistance indicator.

- Curiously, by default, there is no indicator in the MT4 terminal, which would automatically build support and resistance levels. After all, these levels are one of the key elements of technical analysis that many traders use. The Auto Support & Resistance indicator solves this problem.

Indicator description

- The Support and Resistance indicator automatically plots important support and resistance levels in the chart.

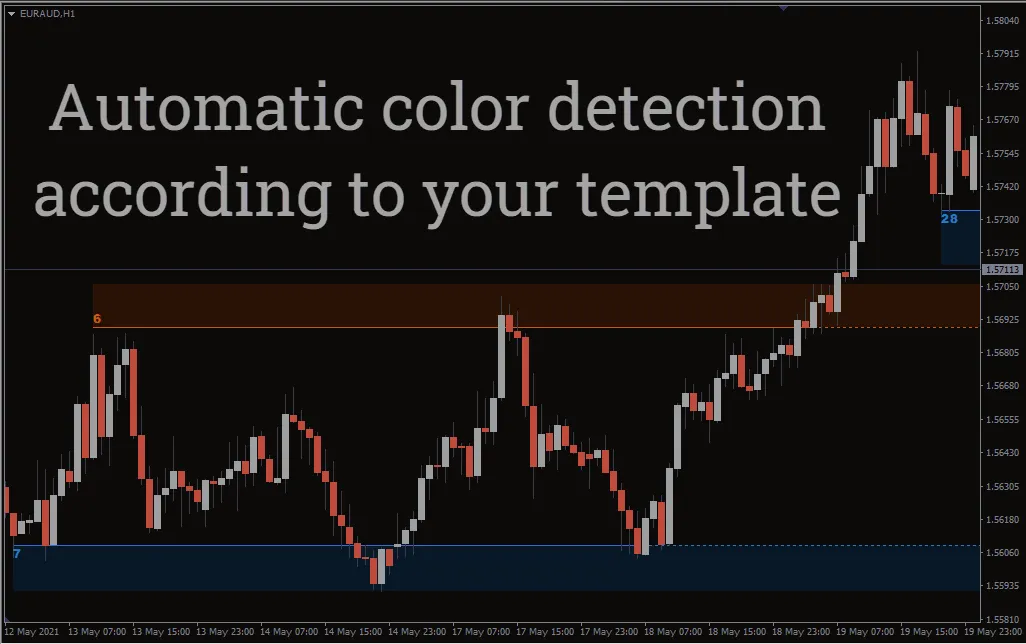

- Resistance levels (zones) are shown with red in the chart, while support levels (zones) are shown with blue. Support levels indicate possible buyers’ interest when the price approaches them.

- Resistance levels indicate the opposite – there could be sellers’ interest if the price approaches these levels.

The auto drawing of actual support and resistance levels by the indicator allows you to save time and effort when analyzing the chart. This will certainly be a big plus for both professionals and novice traders.

- However, for beginners, it is advisable to draw levels manually. This will enhance experience and understanding of pricing in the forex market. In the case of manual drawing of support and resistance levels the automatically drawn levels will be considered as examples and a kind of assistant.

Support and resistance levels displayed by the indicator can be a guide for placing orders when closing positions (stop-loss and take-profit). Also, they help to determine the signals for opening the deals.

Indicator drawing technique

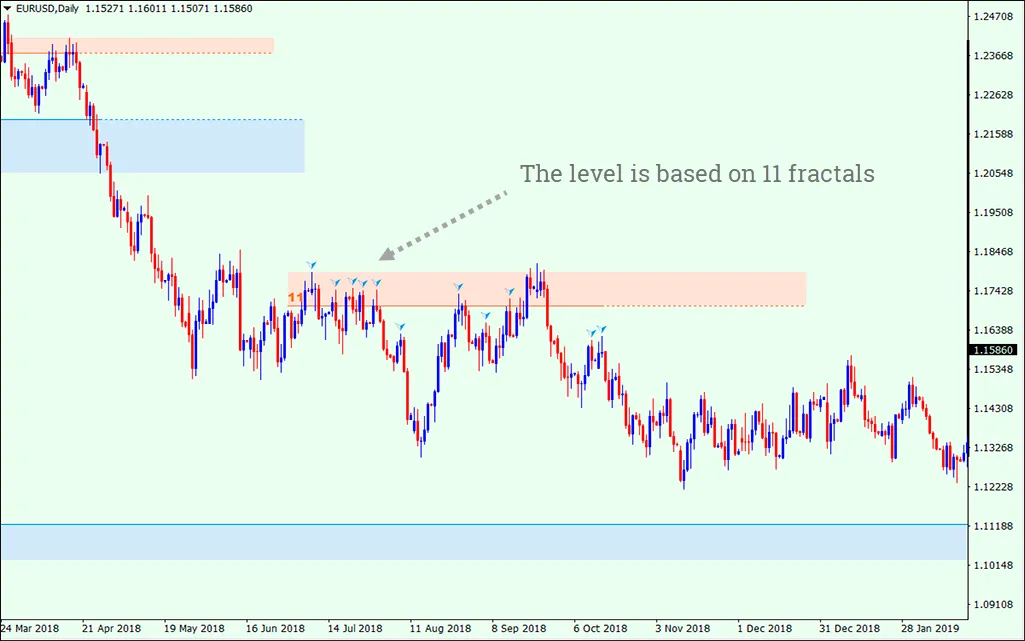

- Support and resistance levels, as a rule, are drawn using market extrema – the so-called fractals. The standard set of indicators in the MT4 terminal contains the Fractals indicator. It displays these extrema.

- The Support and Resistance indicator already includes the Fractals indicator. It plots support and resistance levels by the points where fractals were most numerous.

- The resistance level, in this case, is built according to 11 fractals. You can check which fractals it was built according to by clicking on the number located at the beginning of the resistance level.

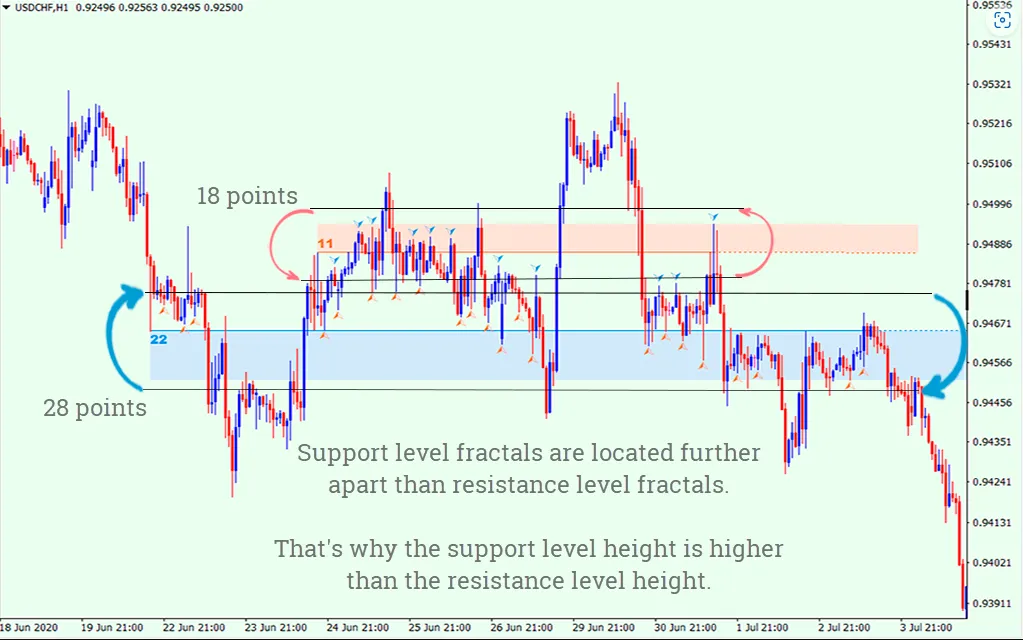

The height of support and resistance levels depends on how far apart the fractals from each other are.

- The greater the distance between the upper and lower fractals of the support/resistance level is, the higher the height of the plotted level will be.

- The opposite is also true: the closer the upper and lower fractals of the level are located to each other, the lower its height will be.

Thus, the indicator does not redraw but changes the levels’ height when new fractals appear.

How to trade using the indicator

- The methods of trading based on support and resistance zones are often represented as signals for breakout or rebound from the levels. However, the trading specifics of these methods are different for flat and trend.

- Trading from the lower to the upper limit of a flat and vice versa is, as a rule, one of the easiest and most profitable trading strategies.

- But it is important to understand that the flat is a temporary phenomenon in the forex market. Sooner or later the flat will be replaced by a trend.

- The combination of support and resistance zones in this case forms a small flat.

- According to the technical analysis, the possibility of breaking through the flat is higher in the direction in which the trend was oriented before the flat. Therefore we assume that a probability of break-up of the resistance zone is a more realistic scenario than a downward movement.

- This allows considering the buy trades from the support zone during the trading day. It also allows considering the trades for a breakout of the flat upwards on the mid/long term.

At the active trend stage, the support and resistance zones act as levels. From these levels, it is possible to make a profitable deal in the direction of the main trend.

The combined use of trend lines and support/resistance zones in the trading system initially increases the chances for a successful deal.

Let’s use the AutoTrendLines indicator to determine the trend.

- A combination of the resistance zone and the downtrend line, in this case, makes it possible to consider sell positions.

Also, the same as in the flat example. Sales from the resistance zone can be considered both within the trading day and for the mid /long term.

Thus, the Support and Resistance indicator may become an essential assistant in the analysis of the chart. The combination of various settings and high efficiency allows productive use of the Support and Resistance zones indicator in the trading system of almost any trader.