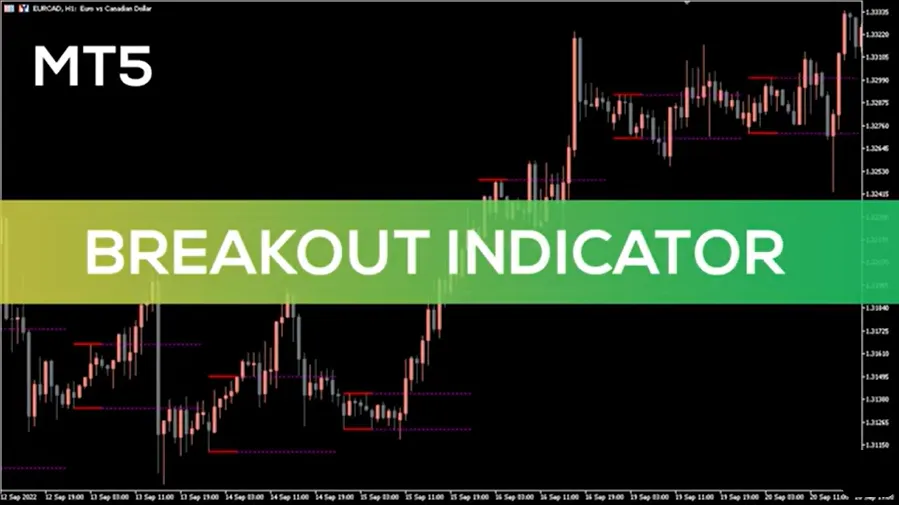

BREAKOUT BOX INDICATOR MT5

Breakout indicator for MT5 support and resistance charts so you can easily see when a breakout candle appears.

- Breakout trading is one of the most common methods in the forex industry due to its potential for making huge pips. Breakout Indicator is the best forex indicator for breakout trading. The indicator identifies and automatically draws a significant support and resistance zone.

This MT5 indicator performs technical analysis on timeframes less than 4 hours. Does not draw levels on timeframes above H1. It is also worth noting that the breakout indicator works best on the H1 timeframe. In addition, the indicator can also be incorporated into various trading styles such as scalping, day trading, and intraday trading.

- The indicator has the potential to add value to your trading as it helps to easily determine the actual level of support or resistance. With this information, you can make trading predictions and be prepared for further price movement.

The breakout indicator would be very helpful for beginner traders who may not know how to identify important support or resistance levels. Of course, experienced traders are not left out, as the indicator also makes technical analysis easier for them. You only need to look at the chart to understand what the market is trying to do.

Breakout Indicator BUY/SELL Signals

The picture above is a GBPUSD chart showing what the breakout indicator looks like on a forex dashboard. On the other hand, the annotations demonstrate how to find a high probability BUY/SELL signal using the breakout indicator.

- This MT5 indicator is so powerful that you can use it alone for successful trading. It doesn’t need any supporting indicators or deep technical analysis skills to pick viable setups. Either way, understanding the price action can further increase your winnings.

- You can use this indicator to trade in two ways. The first approach is to study the general trend of the market shift. Then wait until the price breaks out of the indicator and closes in the direction of the trend before making a BUY/SELL entry. For example, in a rising market, you choose a BUY trade after the price breaks out and closes above the indicator field.

- The second approach, which is the best way to use the breakout indicator, is illustrated in the example chart above. To get high probability trade setups, wait until the candle goes out of the indicator field. Then wait for the NEXT candle to retest and show a sign of visible rejection (long wick). Enter in the direction of the breakout just after the second candle that was rejected ends.

- The logic behind the second approach is simple. Once price breaks out of a support or resistance area and is immediately followed by a rejected candlestick, this means that the breakout area is very strong and price is likely to move in that direction.

Conclusion

- The breakout indicator is a trading tool that should be on your forex chart. It is very effective when used correctly. However, make sure you stick to proper money management as no indicator/strategy is immune to false signals.