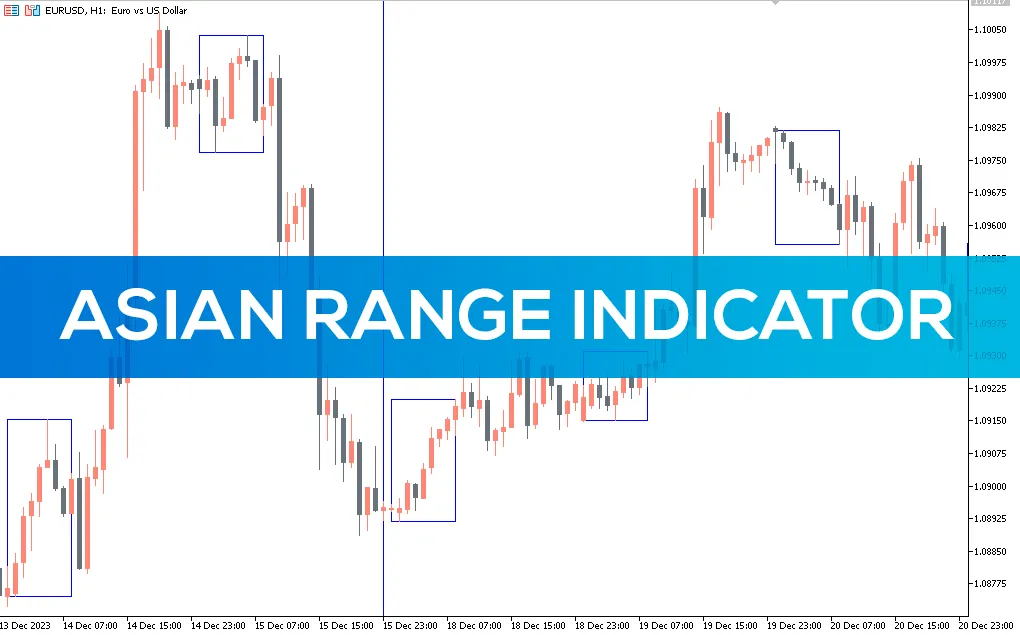

ICT ASIAN RANGE INDICATOR MT5

An excellent tool for a trading strategy based on the Asian session. Asian Range Indicator is an excellent trend reversal and breakout detector.

- Identify stock buy or sell signals in Forex using the Better Volume MT5 indicator. Detects trend reversal patterns. Offers better trading solutions than traditional volume-based indicators. You’ve probably heard about trading strategy. So, the strategy involves trading based on the Asian session.

- Ideally, the Forex market tends to consolidate during the Asian market before experiencing volatile price movements leading to the London and New York sessions. Therefore, trading using this strategy requires a deep understanding of market behavior over four trading sessions.

- However, if you are not good at strategy, don’t worry. This helps to trade the breakouts of the Asian session. The indicator draws colored rectangles that help investors trade the breakout either down or up. You only need to enter a trade when the price breaks out of the box.

The Asian Range indicator works best on shorter time frames such as 1 hour, 15 minutes and 5 minutes.

You can use the indicator to trade Japanese Yen currency pairs. In particular, the indicator works best for the USD/JPY, EUR/JPY, GBP/JPY, GBP/USD and EUR/USD pairs. In fact, the indicator is best suited for trading breakouts.

- The Asian Range indicator is suitable for beginner traders. You don’t need to remember when the Asian range forms. You only need to identify the range drawn by the indicator and place a trade once the price breaks out of the Asian market consolidation.

It is advisable to combine the indicator with other strategies and tools. For example, you can use the Asian range indicator in combination with a retouch/retest strategy. This means that you will enter when the price retests the consolidation phase.

Buy signal

- A bullish signal occurs when the price breaks the high of the range indicated by the upper line.

Sell signal

- A bearish signal occurs when the price breaks the lower limit of the range.

Asian Range Indicator: Trading example

- The picture above shows the price movement of the Euro against the US dollar. The circled area shows price consolidation during the Asian session. The price retested the lows of the swinging market, giving a strong bullish signal. After this move, the price drops sharply and enters a consolidation phase in the next Asian market.

Conclusion

- Asian Range – one of the fashionable trading strategies. It turned out to be very profitable and successful. However, some people do not understand what it is and how to use it. The Asian Range Indicator is an ideal indicator for identifying potentially profitable positions based on the Asian market. This means you’ll see some great movement in the sessions in London and New York. Ultimately, you will increase your trading profits.